Optimizing Business Financial Management Strategies for Success

The Importance of Business Financial Management

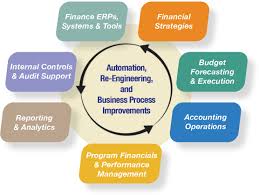

Effective financial management is crucial for the success and sustainability of any business. It involves planning, organizing, controlling, and monitoring a company’s financial resources to achieve its objectives and maximize profits.

One key aspect of financial management is budgeting. By creating a detailed budget that outlines income and expenses, businesses can better allocate resources, identify areas for cost savings, and plan for future growth.

Another important component is cash flow management. Monitoring cash flow allows businesses to ensure they have enough liquidity to cover expenses and invest in opportunities as they arise. Proper cash flow management can prevent financial crises and keep a business operating smoothly.

Financial reporting is also essential for business owners and stakeholders to understand the financial health of the company. Regularly analyzing financial statements such as balance sheets, income statements, and cash flow statements can provide valuable insights into the performance of the business.

Furthermore, risk management plays a critical role in financial management. Businesses must identify potential risks such as economic downturns, industry changes, or regulatory issues and develop strategies to mitigate these risks effectively.

In conclusion, sound financial management practices are vital for the long-term success of any business. By implementing effective budgeting, cash flow management, financial reporting, and risk management strategies, businesses can improve their financial performance, make informed decisions, and achieve their goals.

Essential FAQs on Business Financial Management: Understanding, Improving, and Overcoming Challenges

- What is financial management in business?

- Why is financial management important for businesses?

- How can businesses improve their financial management practices?

- What are the key components of financial management?

- How does budgeting benefit business financial management?

- What role does cash flow play in business financial management?

- Why is risk management crucial in financial management?

- How can businesses analyze their financial performance effectively?

- What are common challenges faced in business financial management?

What is financial management in business?

Financial management in business refers to the strategic planning, organizing, controlling, and monitoring of a company’s financial resources to achieve its goals and objectives effectively. It involves activities such as budgeting, cash flow management, financial reporting, and risk management to ensure the efficient allocation of funds, maximize profits, and maintain financial stability. By implementing sound financial management practices, businesses can make informed decisions, mitigate risks, and ultimately drive sustainable growth and success.

Why is financial management important for businesses?

Financial management is crucial for businesses because it plays a fundamental role in ensuring the organization’s financial health, stability, and growth. Effective financial management allows businesses to plan and allocate resources strategically, optimize cash flow to meet operational needs, make informed investment decisions, and assess performance through accurate financial reporting. By implementing sound financial management practices, businesses can enhance profitability, minimize risks, and navigate challenges in a dynamic economic environment. Ultimately, prioritizing financial management empowers businesses to achieve long-term sustainability and success.

How can businesses improve their financial management practices?

To enhance their financial management practices, businesses can implement several key strategies. Firstly, creating a comprehensive budget that accurately forecasts income and expenses can help in better resource allocation and planning. Secondly, maintaining a close eye on cash flow by monitoring inflows and outflows of funds ensures liquidity and financial stability. Additionally, conducting regular financial analysis through detailed reporting can provide insights into the company’s performance and areas for improvement. Lastly, businesses should prioritize risk management by identifying potential threats and developing proactive strategies to mitigate them effectively. By focusing on these areas, businesses can strengthen their financial management practices and set themselves up for long-term success.

What are the key components of financial management?

Understanding the key components of financial management is essential for the success of any business. The main elements include budgeting, cash flow management, financial reporting, and risk management. Budgeting involves creating a detailed plan that outlines expected income and expenses to help businesses allocate resources effectively. Cash flow management ensures that a company has enough liquidity to cover its operational needs and seize opportunities for growth. Financial reporting provides insights into the financial health of the business through analyzing statements like balance sheets and income statements. Lastly, risk management involves identifying and mitigating potential risks that could impact the financial stability of the business. Mastering these key components is crucial for sound financial decision-making and long-term success in business operations.

How does budgeting benefit business financial management?

Budgeting plays a crucial role in enhancing business financial management by providing a structured framework for planning and controlling financial resources. By creating a detailed budget, businesses can set clear financial goals, allocate resources effectively, and monitor performance against targets. Budgeting helps businesses to identify potential areas for cost savings, prioritize spending, and make informed decisions about investments and expenses. Additionally, budgeting enables businesses to forecast future financial needs, improve cash flow management, and ultimately enhance overall financial stability and profitability.

What role does cash flow play in business financial management?

Cash flow plays a crucial role in business financial management as it serves as the lifeblood of a company’s operations. Cash flow represents the movement of money in and out of a business, reflecting its ability to generate income, meet financial obligations, and invest in growth opportunities. Monitoring cash flow is essential for ensuring that a business has enough liquidity to cover expenses, pay suppliers and employees, and seize strategic opportunities. By effectively managing cash flow, businesses can maintain financial stability, plan for future investments, and navigate economic uncertainties with greater resilience. Ultimately, understanding and optimizing cash flow is key to sustaining the financial health and success of a business.

Why is risk management crucial in financial management?

Risk management is crucial in financial management because it helps businesses identify, assess, and mitigate potential risks that could impact their financial stability and success. By proactively addressing risks such as market fluctuations, regulatory changes, or unexpected events, businesses can protect themselves from potential losses and uncertainties. Effective risk management strategies enable companies to make informed decisions, safeguard their assets, and maintain long-term sustainability in an ever-changing business environment. Prioritizing risk management in financial planning is essential for ensuring the resilience and growth of a business in the face of various challenges and uncertainties.

How can businesses analyze their financial performance effectively?

Analyzing financial performance effectively is crucial for businesses to gauge their success and make informed decisions. One common method is to conduct a thorough review of financial statements, such as balance sheets, income statements, and cash flow statements. By comparing key financial ratios and trends over time, businesses can assess their profitability, liquidity, and overall financial health. Additionally, benchmarking against industry standards and competitors can provide valuable insights into areas for improvement. Utilizing financial analysis tools and software can also streamline the process and generate meaningful reports for better decision-making. Ultimately, by regularly evaluating their financial performance through comprehensive analysis, businesses can identify strengths, weaknesses, and opportunities for growth.

What are common challenges faced in business financial management?

One of the most frequently asked questions in business financial management is about the common challenges faced by organizations. Businesses often encounter various hurdles in managing their finances effectively, such as cash flow fluctuations, inadequate financial planning, difficulty in securing funding, navigating complex regulatory requirements, and dealing with unexpected expenses. These challenges can impede a company’s growth and profitability if not addressed proactively. By understanding and actively mitigating these common obstacles, businesses can strengthen their financial management practices and enhance their overall financial health.