Unlocking Success: Navigating Startup Business Financing Strategies

Startup Business Financing: A Guide to Funding Your Venture

Starting a new business is an exciting endeavor, but one of the biggest challenges entrepreneurs face is securing financing. Whether you have a groundbreaking idea or a unique product, funding is essential to get your startup off the ground and turn your vision into reality.

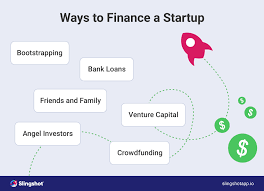

There are various options available for startup business financing, each with its own pros and cons. Here are some common ways entrepreneurs can fund their ventures:

Self-Funding

Many entrepreneurs choose to self-fund their startups using personal savings, assets, or credit cards. While this option allows for greater control and flexibility, it also comes with significant financial risk.

Friends and Family

Another common source of startup funding is friends and family. This can be a quick way to raise capital, but it’s important to formalize the arrangement and clearly outline expectations to avoid potential conflicts down the road.

Angel Investors

Angel investors are individuals who provide capital in exchange for equity in the company. They often have industry experience and can offer valuable advice and connections in addition to funding.

Venture Capitalists

Venture capitalists are professional investors who manage funds from high-net-worth individuals, institutions, or corporations. They typically invest larger sums of money in exchange for equity and expect high returns on their investment.

Crowdfunding

Crowdfunding platforms like Kickstarter or Indiegogo allow entrepreneurs to raise funds from a large number of people in exchange for rewards or early access to products. This option can help validate your idea and build a community around your brand.

Small Business Loans

Banks and financial institutions offer small business loans that can be used to finance startup costs such as equipment purchases, inventory, or marketing expenses. These loans typically require collateral and have specific eligibility criteria.

When considering startup business financing options, it’s important to evaluate your needs, goals, and risk tolerance carefully. Each funding source has its own advantages and challenges, so choose the option that aligns best with your business model and growth strategy.

Remember that securing funding is just the first step in building a successful startup. Proper financial management, strategic planning, and resource allocation are crucial for long-term sustainability and growth.

By exploring different funding avenues and making informed decisions about your startup business financing strategy, you can set yourself up for success in the competitive entrepreneurial landscape.

9 Essential Tips for Financing Your Startup Business

- Create a detailed business plan outlining your financial needs and goals.

- Consider bootstrapping by using personal savings or funds from friends and family.

- Explore crowdfunding platforms to raise capital from a larger pool of investors.

- Seek out angel investors or venture capitalists who specialize in startup funding.

- Apply for small business loans from banks or credit unions to finance your venture.

- Participate in startup competitions or pitch events to attract potential investors.

- Utilize peer-to-peer lending platforms as an alternative financing option.

- Negotiate favorable payment terms with suppliers to improve cash flow management.

- Monitor and track your finances closely to ensure you stay within budget and make informed decisions.

Create a detailed business plan outlining your financial needs and goals.

Creating a detailed business plan outlining your financial needs and goals is a crucial tip for startup business financing. A well-crafted business plan not only helps you clarify your vision and strategy but also serves as a roadmap for securing funding. By clearly articulating your financial requirements, projected expenses, revenue forecasts, and growth targets, you demonstrate to potential investors or lenders that you have a solid understanding of your business and its financial viability. Additionally, a comprehensive business plan can help you make informed decisions, track progress, and adjust strategies as needed to ensure the long-term success of your startup.

Consider bootstrapping by using personal savings or funds from friends and family.

When exploring startup business financing options, one effective tip to consider is bootstrapping by utilizing personal savings or funds from friends and family. Bootstrapping allows entrepreneurs to maintain full control over their venture and avoid taking on external debt or giving up equity too early in the startup’s lifecycle. By leveraging personal resources and support from close contacts, entrepreneurs can kickstart their business with minimal financial risk and build a solid foundation for growth. However, it is essential to approach bootstrapping with careful planning and transparency to ensure clear expectations and responsibilities are established among all parties involved.

Explore crowdfunding platforms to raise capital from a larger pool of investors.

Exploring crowdfunding platforms can be a strategic move for startup business financing, as it offers the opportunity to raise capital from a larger pool of investors. By leveraging these platforms like Kickstarter or Indiegogo, entrepreneurs can showcase their business idea to a wide audience and attract backers who are interested in supporting innovative projects. This approach not only helps in raising funds but also in validating the concept and building a community around the startup, fostering early engagement and loyalty among potential customers and supporters.

Seek out angel investors or venture capitalists who specialize in startup funding.

When seeking startup business financing, it is advisable to explore the option of engaging with angel investors or venture capitalists who specialize in funding early-stage ventures. These investors not only provide financial support but also bring valuable industry expertise, mentorship, and networking opportunities to the table. By partnering with angel investors or venture capitalists who understand the unique challenges and opportunities of startups, entrepreneurs can access not just capital but also strategic guidance that can propel their businesses to new heights.

Apply for small business loans from banks or credit unions to finance your venture.

One effective tip for startup business financing is to consider applying for small business loans from banks or credit unions to secure the necessary funding for your venture. These financial institutions offer loans tailored to meet the specific needs of small businesses, providing access to capital for various purposes such as equipment purchases, working capital, or expansion plans. By exploring loan options from reputable banks and credit unions, entrepreneurs can benefit from competitive interest rates, flexible repayment terms, and professional financial guidance to support their business growth and development initiatives.

Participate in startup competitions or pitch events to attract potential investors.

Participating in startup competitions or pitch events can be a strategic way to attract potential investors for your business. These events provide a platform to showcase your innovative ideas, demonstrate your business acumen, and network with industry professionals and investors. Winning or even just participating in such competitions can help increase visibility for your startup, generate buzz around your brand, and catch the attention of investors looking for promising ventures to support. By leveraging these opportunities, you not only have a chance to secure funding but also gain valuable feedback and mentorship that can propel your business forward.

Utilize peer-to-peer lending platforms as an alternative financing option.

Utilizing peer-to-peer lending platforms can be a valuable alternative financing option for startup businesses. These platforms connect individual investors with borrowers, providing a streamlined and often more accessible way to secure funding compared to traditional sources. By tapping into peer-to-peer lending, entrepreneurs can access capital quickly, with potentially lower interest rates and more flexible terms. This approach not only diversifies funding sources but also allows startups to benefit from a community-driven model that fosters collaboration and support among peers in the entrepreneurial ecosystem.

Negotiate favorable payment terms with suppliers to improve cash flow management.

Negotiating favorable payment terms with suppliers is a valuable tip for startup business financing. By extending payment deadlines or securing discounts for early payments, entrepreneurs can effectively manage cash flow and improve the financial health of their ventures. This strategy allows startups to maintain a healthy balance between outgoing expenses and incoming revenue, providing more flexibility in budgeting and investment decisions. Establishing strong relationships with suppliers through fair negotiations not only benefits the bottom line but also fosters trust and long-term partnerships that can support the growth and sustainability of the business.

Monitor and track your finances closely to ensure you stay within budget and make informed decisions.

Monitoring and tracking your finances closely is crucial when it comes to startup business financing. By staying within budget and keeping a close eye on your financial performance, you can make informed decisions that are essential for the success of your venture. Regularly reviewing your income, expenses, and cash flow not only helps you identify potential issues early on but also allows you to adjust your strategies and allocate resources effectively. With a clear understanding of your financial status, you can navigate challenges confidently and steer your startup towards sustainable growth and profitability.