Strategies for Small Business Finance Success: Navigating Financial Challenges with Confidence

Understanding Small Business Finance: Key Concepts and Strategies

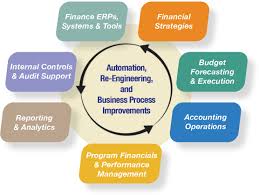

Small businesses play a crucial role in driving economic growth and innovation. To thrive in today’s competitive market, small business owners must have a solid understanding of finance and how to manage their financial resources effectively. Here are some key concepts and strategies to help small business owners navigate the complex world of finance:

Budgeting

Creating a budget is essential for small businesses to track income, expenses, and cash flow. By setting financial goals and monitoring spending, small business owners can make informed decisions about resource allocation and identify areas for cost savings.

Cash Flow Management

Cash flow is the lifeblood of any small business. Managing cash flow effectively involves monitoring incoming and outgoing funds, anticipating future expenses, and maintaining a healthy cash reserve to cover unexpected costs.

Financing Options

Small business owners have various financing options available, such as loans, lines of credit, or investment partnerships. It’s essential to explore these options carefully and choose the one that best fits the business’s needs while considering factors like interest rates, repayment terms, and collateral requirements.

Financial Analysis

Conducting regular financial analysis helps small business owners evaluate their performance, identify trends, and make strategic decisions based on data-driven insights. Key financial metrics to monitor include profitability ratios, liquidity ratios, and debt-to-equity ratios.

Tax Planning

Tax planning is crucial for small businesses to minimize tax liabilities legally while maximizing deductions and credits. Small business owners should stay informed about tax laws and regulations that may impact their operations and seek professional advice when needed.

Risk Management

Risk management involves identifying potential risks that could affect the business’s financial stability and implementing strategies to mitigate those risks. This may include purchasing insurance coverage, diversifying revenue streams, or creating contingency plans for unforeseen events.

In conclusion, mastering small business finance is essential for long-term success and sustainability. By implementing these key concepts and strategies effectively, small business owners can build a strong financial foundation that supports growth, innovation, and resilience in an ever-changing market landscape.

Essential FAQs on Small Business Finance: Budgeting, Funding, and Financial Management

- What are the best financing options for small businesses?

- How can I create a budget for my small business?

- What is cash flow management and why is it important for small businesses?

- How can small business owners improve their creditworthiness?

- What tax deductions are available for small businesses?

- What financial metrics should small business owners monitor regularly?

- How can I secure funding for my startup business?

- What are the common challenges in managing small business finances?

- How can risk management strategies benefit small businesses?

What are the best financing options for small businesses?

When considering the best financing options for small businesses, it is essential to weigh various factors to determine the most suitable choice. Small business owners have a range of financing options available, including traditional bank loans, lines of credit, SBA loans, crowdfunding, venture capital, and angel investors. Each option comes with its own advantages and considerations, such as interest rates, repayment terms, collateral requirements, and funding speed. Small business owners should carefully evaluate their financial needs, risk tolerance, and growth plans to select the financing option that aligns best with their goals and circumstances. By conducting thorough research and seeking professional guidance when needed, small business owners can make informed decisions to secure the financing that will support their business’s success and growth.

How can I create a budget for my small business?

Creating a budget for your small business is a crucial step in financial planning and management. Start by outlining your expected income and expenses, taking into account both fixed costs (such as rent and utilities) and variable costs (like inventory or marketing expenses). Set realistic revenue goals and allocate funds accordingly to different areas of your business. Regularly monitor your budget against actual financial performance, making adjustments as needed to ensure you stay on track. By creating a detailed budget, you can gain better control over your finances, identify potential areas for cost savings, and make informed decisions to support the growth and sustainability of your small business.

What is cash flow management and why is it important for small businesses?

Cash flow management is the process of monitoring, analyzing, and optimizing the inflow and outflow of cash within a business. It involves tracking the money coming into the business from sales or investments and the money going out to pay expenses such as rent, salaries, and suppliers. Effective cash flow management is crucial for small businesses because it ensures they have enough liquidity to cover operational expenses, invest in growth opportunities, and weather financial challenges. By maintaining a healthy cash flow, small businesses can avoid cash shortages, make timely payments to vendors and employees, and make strategic decisions that support long-term success and sustainability.

How can small business owners improve their creditworthiness?

Small business owners can improve their creditworthiness by taking proactive steps to build a strong financial profile. One key strategy is to establish a solid payment history by paying bills on time and in full, as this demonstrates reliability and financial responsibility to creditors. Additionally, keeping personal and business finances separate can help maintain clarity and organization in financial records. Small business owners should also regularly monitor their credit reports for errors or discrepancies that could negatively impact their credit score. By managing debt levels wisely, diversifying sources of credit, and demonstrating steady revenue growth, small business owners can enhance their creditworthiness and access better financing opportunities for future growth and expansion.

What tax deductions are available for small businesses?

Small businesses can take advantage of various tax deductions to reduce their taxable income and lower their overall tax liability. Common tax deductions available for small businesses include deductions for business expenses such as rent, utilities, supplies, and equipment. Small business owners can also deduct expenses related to employee wages, benefits, and insurance premiums. Additionally, deductions for home office expenses, mileage, travel costs, professional services, and marketing expenses are often available to small businesses. It is essential for small business owners to keep detailed records of all expenses and consult with a tax professional to ensure they are maximizing their eligible deductions while staying compliant with tax laws and regulations.

What financial metrics should small business owners monitor regularly?

Small business owners should regularly monitor a range of financial metrics to ensure the financial health and sustainability of their businesses. Key financial metrics that small business owners should pay close attention to include profitability ratios, such as gross profit margin and net profit margin, which indicate how efficiently the business is generating profits. Additionally, liquidity ratios like the current ratio and quick ratio are crucial for assessing the company’s ability to meet short-term obligations. Debt-to-equity ratio is another important metric that helps small business owners evaluate their leverage and financial risk. By tracking these financial metrics regularly, small business owners can gain valuable insights into their financial performance and make informed decisions to drive long-term success.

How can I secure funding for my startup business?

Securing funding for a startup business is a common challenge that many entrepreneurs face. There are several avenues available to secure funding for your startup, including traditional bank loans, small business grants, angel investors, venture capital firms, crowdfunding platforms, and personal savings. It’s essential to research and explore these options carefully to determine which aligns best with your business goals and financial needs. Developing a solid business plan, demonstrating market potential and profitability, and showcasing your passion and commitment to the venture can also increase your chances of securing funding from investors or lenders. Building strong relationships within the entrepreneurial community and seeking guidance from mentors or advisors can provide valuable insights and support in navigating the complex landscape of startup financing.

What are the common challenges in managing small business finances?

Managing small business finances presents several common challenges that business owners often face. One significant challenge is maintaining a stable cash flow, as fluctuations in revenue and expenses can impact the business’s financial health. Additionally, securing adequate funding to support growth and operations can be a hurdle, especially for new or expanding businesses. Keeping accurate financial records and staying compliant with tax regulations are also common challenges that require attention to detail and organization. Lastly, balancing short-term financial needs with long-term strategic planning poses a challenge for small business owners seeking sustainable growth and profitability in a competitive market environment. Addressing these challenges proactively through sound financial management practices is essential for the success and longevity of small businesses.

How can risk management strategies benefit small businesses?

Implementing effective risk management strategies can greatly benefit small businesses by helping them safeguard their financial stability and long-term success. By identifying potential risks, such as market fluctuations, regulatory changes, or unexpected events, small business owners can proactively mitigate these risks and minimize their impact on operations. Risk management strategies enable businesses to make informed decisions, allocate resources wisely, and protect against potential financial losses. Ultimately, by integrating risk management practices into their operations, small businesses can enhance resilience, improve decision-making processes, and ensure sustainable growth in an increasingly competitive business environment.