Navigating the Ever-Changing Real Estate Market: Insights and Opportunities

The Real Estate Market: A Snapshot of Opportunities and Challenges

The real estate market is a dynamic and ever-changing landscape that plays a vital role in our economy. Whether you are a homeowner, investor, or aspiring buyer, understanding the trends and forces shaping this market can be crucial in making informed decisions.

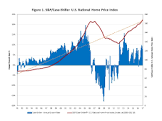

In recent years, the real estate market has experienced both ups and downs. From the housing bubble burst in 2008 to the subsequent recovery and steady growth, it has been a journey of resilience and adaptation. Today, as we navigate through unprecedented times brought on by the global pandemic, the real estate market continues to evolve.

One notable trend is the shift towards suburban living. With remote work becoming more prevalent, many individuals and families are reevaluating their priorities and seeking larger homes outside of crowded urban centers. This has led to increased demand for suburban properties with spacious yards and home offices.

On the other hand, urban areas have faced unique challenges due to changes in lifestyle brought on by the pandemic. The rise of remote work and concerns about public transportation have impacted demand for city apartments and condos. However, it’s important to note that cities have historically shown resilience in bouncing back from crises, so it will be interesting to see how these markets adapt moving forward.

Another factor influencing the real estate market is interest rates. In an effort to stimulate economic growth during uncertain times, central banks have implemented low interest rate policies. This has made borrowing more affordable for potential buyers or investors looking to enter the market. Low-interest rates have contributed to increased demand for housing as well as a surge in refinancing activities.

However, despite these opportunities, challenges remain within the real estate market. Affordability remains a significant concern in many regions across the country. As home prices rise faster than wages in some areas, it becomes increasingly difficult for first-time buyers to enter the market. This issue highlights the need for innovative solutions such as affordable housing initiatives and creative financing options.

Moreover, the market’s stability can be influenced by various external factors. Economic fluctuations, government policies, and natural disasters all have the potential to impact real estate values and market dynamics. Staying informed about these factors can help individuals make well-informed decisions and mitigate potential risks.

In conclusion, the real estate market is a complex ecosystem that offers both opportunities and challenges. Understanding the current trends, such as the shift towards suburban living and low-interest rates, can provide valuable insights for buyers and investors. However, it is crucial to remain mindful of affordability concerns and external factors that may influence market stability. By staying informed and seeking professional advice when needed, individuals can navigate the real estate market with confidence and make sound decisions that align with their goals.

Commonly Asked Questions About the Current Real Estate Market in the US and California

- What is the housing market in the US right now?

- Will 2023 be a good time to buy a house?

- Will it ever be a good time to buy a house?

- How is California’s housing market?

What is the housing market in the US right now?

The housing market in the US is currently experiencing a unique and dynamic situation. Despite the challenges posed by the global pandemic, the market has shown surprising resilience and even strong growth in some areas.

One notable trend is the rise in home prices. Across many regions, there has been a significant increase in home values over the past year. Low mortgage rates, coupled with limited housing inventory, have created a competitive environment for buyers. This surge in demand has led to bidding wars and increased competition among potential homeowners.

Low-interest rates have been a driving force behind this increased demand. The Federal Reserve’s commitment to keeping rates low has made borrowing more affordable, enticing many buyers to enter or upgrade their homes. This has also fueled a surge in refinancing activities as homeowners take advantage of lower rates to reduce their monthly mortgage payments.

Another factor contributing to the current housing market is the shift towards suburban living. With remote work becoming more prevalent, many individuals and families are seeking larger homes outside of crowded urban centers. This trend has driven up demand for single-family houses with spacious yards and home office spaces.

However, it’s important to note that not all segments of the housing market are experiencing equal growth. While single-family homes have seen strong demand and price appreciation, condominiums and apartments in urban areas have faced some challenges due to lifestyle changes brought on by the pandemic.

Additionally, housing affordability remains a concern for many potential buyers. As home prices rise faster than wages in some areas, it becomes increasingly difficult for first-time buyers to enter the market. This affordability gap highlights the need for innovative solutions such as affordable housing initiatives and creative financing options.

Overall, while there are challenges and variations within different regions and segments of the housing market, it is important to recognize that conditions remain favorable for sellers due to high demand and limited inventory. However, buyers should be prepared for competitive bidding situations and consider working with real estate professionals who can provide guidance throughout the process.

As the economy continues to recover and the pandemic situation evolves, it will be interesting to see how the housing market adapts. Staying informed about market trends, interest rates, and local conditions will be crucial for anyone looking to buy or sell a home in the current environment.

Will 2023 be a good time to buy a house?

Predicting the future state of the real estate market is challenging, as it is influenced by numerous factors that can change over time. While I cannot provide a definitive answer, I can offer some insights to consider when contemplating whether 2023 would be a good time to buy a house.

Firstly, it’s important to recognize that real estate markets can vary significantly by location. Factors such as local economic conditions, population growth, and housing supply and demand dynamics play a significant role in determining market conditions. Therefore, it’s essential to assess the specific market you are interested in rather than making general assumptions.

Secondly, understanding current trends and forecasts can provide some guidance. Keep an eye on indicators such as mortgage interest rates, employment rates, and housing inventory levels. Low-interest rates can make homeownership more affordable, while job growth and low unemployment rates generally indicate a stable housing market.

Additionally, analyzing historical data can offer insights into market cycles. Real estate markets tend to have periods of growth followed by corrections or slowdowns. By studying past trends in your target area, you may gain an understanding of how the market has behaved historically and make informed decisions based on that information.

It’s also worth considering external factors that could impact the real estate market in 2023. Economic conditions, government policies related to housing and taxation, and unforeseen events (such as natural disasters or global crises) can all influence housing prices and demand.

Ultimately, whether 2023 is a good time to buy a house will depend on your personal circumstances and goals. Factors such as your financial stability, long-term plans for homeownership, and ability to secure favorable financing should all be taken into account.

To make an informed decision about buying a house in 2023 or any other year, it is advisable to consult with local real estate professionals who have expertise in your target area. They can provide valuable insights based on their knowledge of the local market and help you assess the current conditions and future prospects.

Will it ever be a good time to buy a house?

Determining the “right” time to buy a house is a personal decision that depends on various factors, including your financial situation, long-term goals, and the state of the real estate market. While it is impossible to predict the future with certainty, there are certain considerations that can help you make an informed decision.

One important factor to consider is your financial readiness. Purchasing a home is a significant financial commitment, and it’s crucial to ensure that you have a stable income, a solid credit history, and sufficient savings for a down payment and ongoing expenses such as mortgage payments, property taxes, and maintenance costs.

Additionally, assessing the state of the real estate market can provide insights into whether it may be advantageous to buy at a particular time. Real estate markets can experience fluctuations in prices and inventory levels. When demand is high and supply is low, prices tend to rise. Conversely, during periods of economic downturn or increased supply, prices may become more favorable for buyers.

Interest rates also play a significant role in determining the affordability of homeownership. Low-interest rates can make borrowing more affordable and increase your purchasing power. Keeping an eye on interest rate trends can help you gauge whether it’s a favorable time to secure financing.

However, it’s important not to solely base your decision on market conditions or timing. Buying a home should align with your long-term goals and lifestyle needs. Consider factors such as job stability, desired location, family plans, and the potential for future growth in property value.

Ultimately, there may never be an absolutely perfect time to buy a house. Real estate markets are cyclical and influenced by numerous factors beyond our control. Instead of trying to time the market perfectly, focus on your personal circumstances and goals. If you have assessed your financial readiness, researched the local market conditions thoroughly, and found a property that meets your needs within your budget, it may be an opportune time for you personally to embark on homeownership.

How is California’s housing market?

California’s housing market has long been known for its unique dynamics and challenges. As the most populous state in the United States, California boasts a diverse range of urban and suburban areas, each with its own real estate market characteristics.

In recent years, California’s housing market has experienced significant price appreciation, driven by high demand and limited housing supply. The combination of a growing population, strong job market, and desirable lifestyle has led to increased competition for homes across the state.

One of the key challenges in California’s housing market is affordability. The cost of homeownership or renting in many parts of the state is considerably higher than the national average. This affordability gap has made it increasingly difficult for first-time buyers to enter the market and has caused some residents to seek more affordable options outside of major metropolitan areas.

Another factor impacting California’s housing market is supply constraints. Limited land availability, strict zoning regulations, and lengthy approval processes have contributed to a shortage of housing units. This imbalance between supply and demand has put upward pressure on prices.

Additionally, California’s coastal regions are particularly sought after due to their desirable climate and proximity to major job centers. This high demand for coastal properties has resulted in even greater price escalation in these areas.

However, it’s important to note that California’s housing market is not uniform across the entire state. Different regions can exhibit varying trends and dynamics. For example, cities like San Francisco and Los Angeles have historically seen robust price growth but also face affordability challenges. In contrast, some inland cities may offer more affordable options but may experience slower appreciation rates.

The COVID-19 pandemic has also had an impact on California’s housing market. While there was a temporary slowdown in activity during the initial stages of the pandemic, the market quickly rebounded as low-interest rates and pent-up demand drove buyer activity. Remote work trends have also influenced buyer preferences as some individuals seek larger homes or more suburban living environments.

In summary, California’s housing market is characterized by high demand, limited supply, and affordability challenges. While the market has shown resilience and adaptability over time, addressing the housing shortage and improving affordability remain critical issues for policymakers and stakeholders. As always, it is advisable for individuals interested in California’s housing market to consult with local real estate professionals to gain a deeper understanding of specific trends and opportunities in their desired areas.