Analyzing Synchrony Financial Stock Performance: Insights and Trends

Synchrony Financial Stock: A Closer Look at the Company’s Performance

Synchrony Financial is a leading consumer financial services company that offers a range of credit products to consumers and businesses. The company’s stock performance is closely watched by investors and analysts alike, as it provides insights into the overall health of the financial sector.

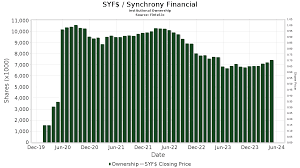

Over the past year, Synchrony Financial stock has shown resilience in the face of market volatility. Despite challenges posed by the COVID-19 pandemic and economic uncertainty, the company has managed to maintain a relatively stable stock price.

One key factor contributing to Synchrony Financial’s stock performance is its strong business model and diversified product offerings. The company has strategically positioned itself in the market, offering credit cards, installment loans, and other financial products that cater to a wide range of consumer needs.

Additionally, Synchrony Financial’s focus on innovation and technology has helped drive its growth in recent years. The company has invested in digital capabilities and data analytics to enhance customer experience and streamline its operations.

Looking ahead, analysts remain optimistic about Synchrony Financial’s prospects. With a solid track record of performance and a commitment to innovation, the company is well-positioned to navigate challenges and capitalize on opportunities in the evolving financial landscape.

In conclusion, Synchrony Financial stock continues to be a strong contender in the financial services sector. As investors monitor its performance closely, the company’s strategic initiatives and market positioning are expected to drive long-term value for shareholders.

Top 8 FAQs About Synchrony Financial Stock: Performance, Outlook, and More

- What is Synchrony Financial?

- How has Synchrony Financial stock performed recently?

- What factors influence the performance of Synchrony Financial stock?

- What products and services does Synchrony Financial offer?

- What is the market outlook for Synchrony Financial stock?

- How does Synchrony Financial differentiate itself from competitors in the financial sector?

- What are analysts’ recommendations for investing in Synchrony Financial stock?

- How has the COVID-19 pandemic impacted Synchrony Financial’s stock performance?

What is Synchrony Financial?

Synchrony Financial is a prominent consumer financial services company that specializes in offering a diverse range of credit products to both individual consumers and businesses. As a leading player in the financial sector, Synchrony Financial is known for its innovative approach to providing credit solutions, including credit cards, installment loans, and other financial products tailored to meet the needs of its customers. With a strong focus on customer experience and technological advancements, Synchrony Financial has established itself as a trusted partner for individuals seeking reliable and flexible financial services.

How has Synchrony Financial stock performed recently?

Recently, the performance of Synchrony Financial stock has been closely monitored by investors and analysts. Despite market volatility and economic challenges, Synchrony Financial has demonstrated resilience with a relatively stable stock price. The company’s strong business model, diversified product offerings, and focus on innovation have contributed to its consistent performance in the face of uncertainties. Analysts remain optimistic about Synchrony Financial’s prospects, citing its track record of success and commitment to driving growth through technology and customer-centric strategies.

What factors influence the performance of Synchrony Financial stock?

Various factors influence the performance of Synchrony Financial stock. One key factor is the overall health of the economy, as consumer spending and credit demand are closely tied to economic conditions. Additionally, company-specific factors such as financial performance, strategic initiatives, and market positioning play a significant role in determining the stock’s performance. Investor sentiment, industry trends, regulatory environment, and macroeconomic indicators also impact Synchrony Financial stock. Keeping a close eye on these factors can provide valuable insights into the potential drivers of the company’s stock performance.

What products and services does Synchrony Financial offer?

Synchrony Financial offers a diverse range of products and services tailored to meet the financial needs of consumers and businesses. The company specializes in providing credit solutions, including credit cards, installment loans, and other financing options. Synchrony Financial partners with a wide array of retailers, healthcare providers, and other businesses to offer branded credit cards that come with various benefits and rewards programs. Additionally, the company provides digital banking services and innovative financial solutions aimed at enhancing customer experience and driving financial wellness. With its focus on consumer finance and strategic partnerships, Synchrony Financial continues to be a prominent player in the financial services industry.

What is the market outlook for Synchrony Financial stock?

Investors and analysts frequently inquire about the market outlook for Synchrony Financial stock. The current sentiment surrounding Synchrony Financial stock is cautiously optimistic, with many experts pointing to the company’s resilient performance and strategic positioning in the financial services sector. Despite market volatility and economic uncertainties, Synchrony Financial’s strong business model, diversified product offerings, and focus on innovation have instilled confidence among investors. Analysts anticipate that Synchrony Financial stock will continue to show stability and potential for growth, driven by the company’s commitment to customer-centric strategies and technological advancements.

How does Synchrony Financial differentiate itself from competitors in the financial sector?

Synchrony Financial sets itself apart from competitors in the financial sector through its focus on innovation, customer-centric approach, and diversified product offerings. The company places a strong emphasis on leveraging technology to enhance the customer experience, offering tailored financial solutions that cater to a wide range of consumer needs. Additionally, Synchrony Financial’s strategic partnerships with leading retailers and businesses have helped expand its market presence and reach. By combining these factors with a commitment to operational excellence and data-driven decision-making, Synchrony Financial establishes itself as a formidable player in the financial services industry, distinguishing itself through a blend of innovation, customer service, and strategic collaborations.

What are analysts’ recommendations for investing in Synchrony Financial stock?

When considering investing in Synchrony Financial stock, it is important to take into account the recommendations provided by analysts. Analysts’ opinions on Synchrony Financial stock vary, with some recommending it as a buy, others suggesting holding onto existing positions, and some advising to sell. Factors influencing these recommendations may include the company’s financial performance, market trends, industry outlook, and overall economic conditions. It is advisable for investors to conduct thorough research and consider multiple sources of information before making investment decisions regarding Synchrony Financial stock.

How has the COVID-19 pandemic impacted Synchrony Financial’s stock performance?

The COVID-19 pandemic has had a notable impact on Synchrony Financial’s stock performance. Like many companies in the financial sector, Synchrony Financial faced challenges as a result of the economic uncertainty and market volatility brought about by the pandemic. The company’s stock experienced fluctuations in response to shifting consumer behaviors, changes in spending patterns, and overall market conditions. Despite these challenges, Synchrony Financial has demonstrated resilience and adaptability in navigating the uncertainties posed by the pandemic, with its strategic initiatives and focus on digital innovation playing a key role in mitigating some of the impacts on its stock performance. Investors continue to monitor how Synchrony Financial responds to ongoing developments related to the pandemic and its implications for the financial services industry.